Want to Be Wealthy? Passive Income Streams You Must Have

The typical routine we know in society is: wake up, go to work, get paid, and repeat until your body starts to tire. I’m referring to the traditional 9-to-5 (W-2 income). While this is a reliable way to make money, imagine if you could earn money on autopilot—even while you’re sleeping.

You might ignore passive income sources now while you have the energy to work, but remember that your body isn’t built to work forever. Plus, since you can’t work 24 hours a day, your earning potential is limited. By focusing on passive income sources, you can ensure a continuous stream of money, 24/7.

The Best Passive Income Sources to Grow Your Wealth

1. REITs

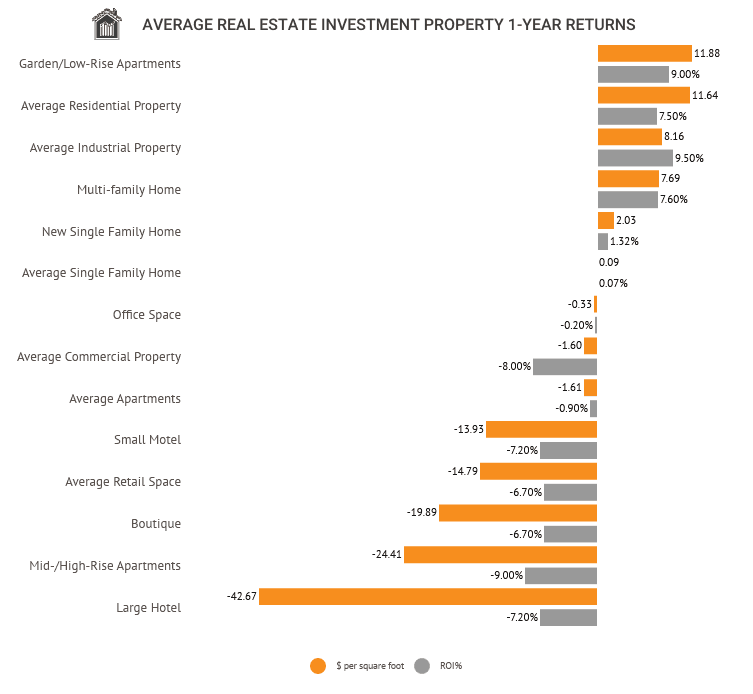

Investing in REITs is one good way to earn passive income. The full meaning of REIT is Real Estate Investment Trust. Real estate investing has been a major way to build wealth for years.

Image Source: iProperty Management

However, traditional real estate investing requires substantial knowledge, cash, and time, and you might end up with a bad rental property that drains your finances. If you’re not prepared for that, investing in REITs (Real Estate Investment Trusts) is a better option.

With REITs, you buy shares in a company that invests in rental properties, allowing you to benefit from real estate investments without the direct hassle.

2. Dividend Stocks

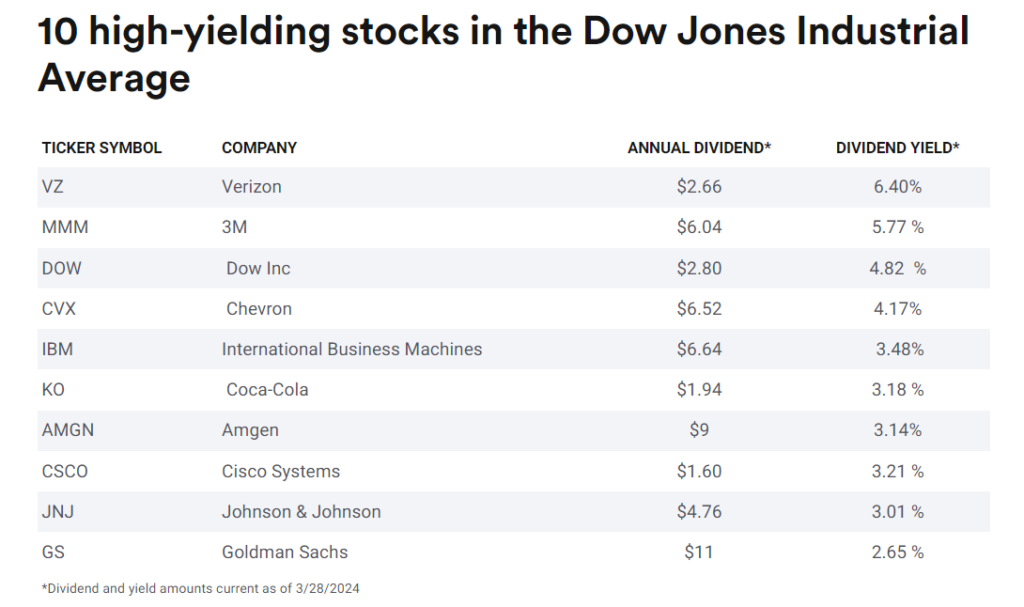

Another great way to receive passive income is to invest in dividend stocks. “Do you know one thing that gives me pleasure?”, as John D. Rockefeller Sr., one of the wealthiest people in history, would say, “It’s to see my dividends coming in”.

Earning passive income from dividend stocks is quite simple. You invest in a publicly traded company, and they pay out part of their profits to shareholders as dividends. How much you earn depends on the company’s profits and the number of shares you own. Usually, dividends are paid out every three months (quarterly).

You can start investing in dividend stocks today by using stock brokerage apps like:

- Robinhood

- TD Ameritrade

- Interactive Brokers

- E*Trade

- Charles Schwab

- Webull.

Alternatively, you can invest in dividend stocks through your retirement plan, like an IRA.

3. Rent out your Spare Room

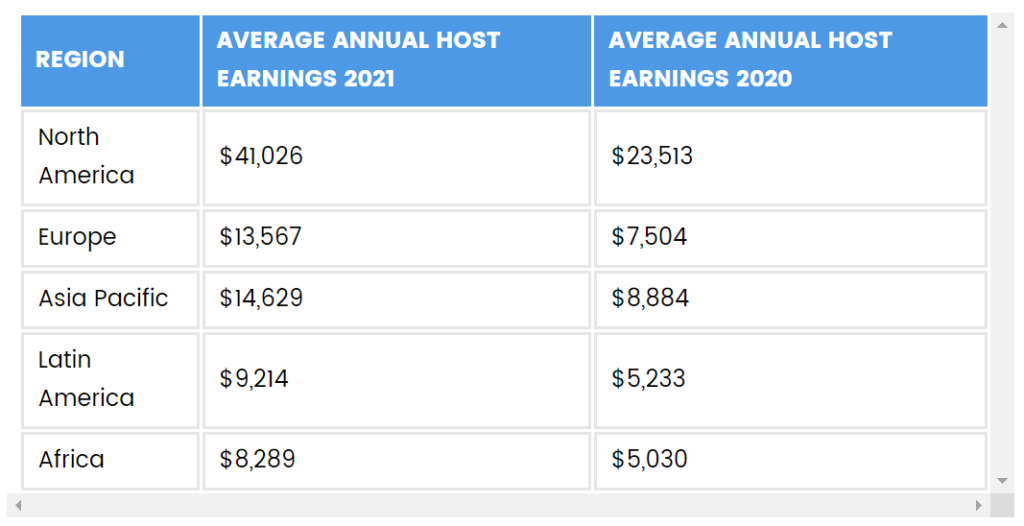

I also suggest considering renting out the spare room in your house. If you don’t mind having guests, this can be a great way to earn passive income.

You can become a host on a platform like Airbnb to rent out your room or entire house. According to ZipRecruiter, the average Airbnb host income in the United States is $37,956 per year in 2024.

Here’s an estimate of how much you can earn annually on each continent, based on data released by AllTheRooms.com.

Aside from Airbnb, here are other places where you can rent out your space or spare room:

- Neighbor: You can rent out your attic, basement, warehouse, bedroom, driveway, etc.

- StoreAtMyHouse

- ShareMySpace

4. Open a High-Yield Savings Account

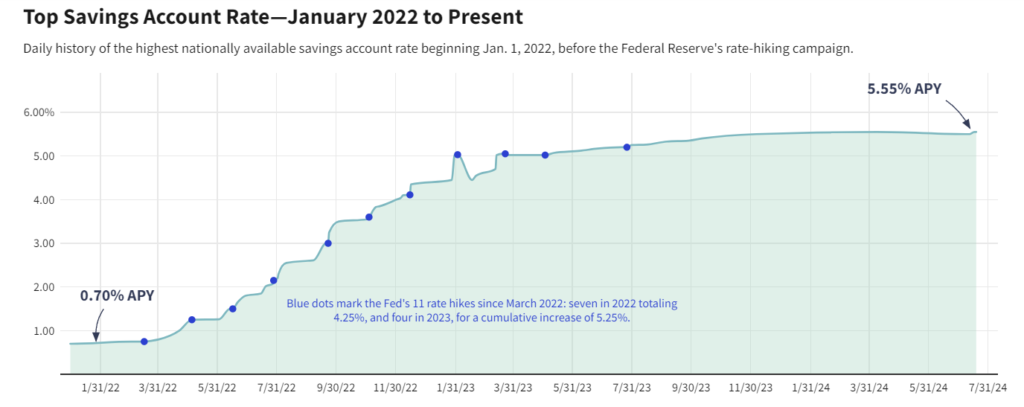

If you want to grow your money, you should think about opening a high-yield savings account. It’s a really easy way to earn some passive income. Instead of sticking your money in a traditional savings account that barely gives you any interest, you can get much better returns with a high-yield savings account.

With some of the best high-yield savings accounts, you can receive up to 5.55% APYs (annual percentage yields).

Image Source: Investopedia Daily Rate Research

Here are some of the best high-yield savings accounts as of July 2024.

- My Direct Bank – 5.45% APY

- UFB Direct – 5.25% APY

- Upgrade – 5.21% APY

- Bread Savings – 5.15% APY

- CIT Bank – 5.00% APY

- Lending Club – 5.00% APY.

5. Rent out your Car

You can rent out your car just like you would rent out a spare room for passive income. If your car is often sitting idle during the day, you can list it on various car-sharing sites.

Here are the best car-sharing platforms:

- HyreCar

- Getaround

- Avail

- Turo.

Final Words

Now you know some of the best passive income streams you can use to create wealth. I hope that you take action on them soon.

I wish you more dollars and freedom. Cheers!

Manuelo is an entrepreneur and a personal finance nerd. He is the founder of Dollars And Freedom. An expert in side hustles, online gigs, and everything about making money. His works have been featured on major financial publications, such as Business Insider, GoBankingRates, Investopedia, Entrepreneur, and more. When he’s not busy with his blog or writing for others, you’ll catch him hanging out with loved ones or reading books on stoicism and self-development.