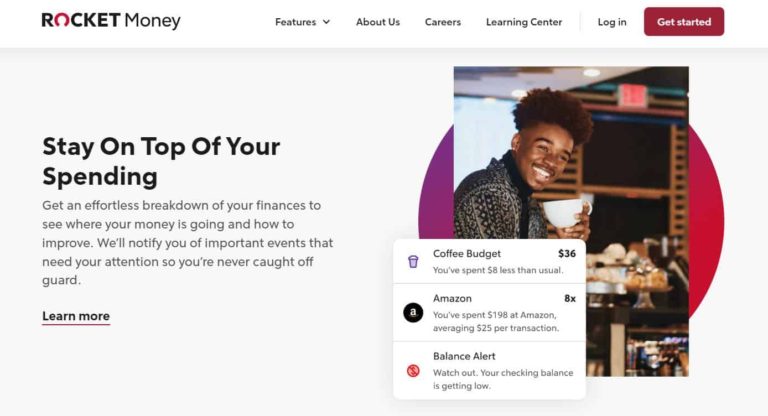

Rocket Money Review 2024: Is Rocket Money A Legit Bill Negotiation App?

Do you want to know whether Rocket Money is a legit bill negotiation app and how using it can actually help you to lower your bills, save money, and finally achieve financial freedom? If you said yes then this article reviews the Rocket Money in detail.

Rocket Money’s Mission

According to Rocket Money, this is its mission: To empower people to live their best financial lives. It offers its members a unique understanding of their finances and a suite of valuable services that save them time and money – ultimately giving them a leg up on their financial journey.

Quick Overview of Rocket Money

- App Name: Rocket Money, formerly known as Truebill

- Number of Users: 3.4 million+

- Available On: iOS and Android

- Services: Bill negotiation, Subscription tracking & cancelling, Budgeting, Outage monitoring and Electric saving.

- Cost: Free plan and Premium plan at $3 – $12 per month.

- Promotions: None

What Is Rocket Money?

Rocket Money is a money management app developed to help people lower their monthly bills which in effect, enables them to save more and in the long run lets them achieve financial stability.

So the app was launched in 2015 as Truebill and got rebranded as Rocket Money a few years ago. Since its inception, the app has helped more than 3.4 million people to get good at managing their money. Rocket Money allows its users to create budgets, oversee subscriptions, negotiate for lower bills, track spending, set up automated savings, and many more.

Why overseeing subscriptions is so important?

Before automatic subscription was introduced, you had to log into their accounts at the end of every month to pay for a service you had subscribed for. If it happened that you had subscribed for 20 services or products, you had to log in one after the other to renew the subscription – that was kinda hectic, so I guess now the stress has been reduced because of automatic subscription.

However, the downside of this was that it may happen that you’ve stopped using the service you subscribed for but since you have many things going on, you could easily forget to cancel the plan. This means you’ll be deducted every month because of the auto-subscription, even though you’ve stopped using the service. So basically, automatic billing or subscription is a double-edged sword and companies like Audible, Amazon, Netflix, Hulu, Time Warner Cable, and others use that purposely in their favor because they’re much aware that you’d definitely forget to cancel the plan. They would continue to eat from your bank account for who knows how long? It could be 2 years or more.

But using Rocket Money means you’re going to have a leg up and services would have no chance of draining your bank account.

How Much Money Can You Save With Rocket Money?

If you’re able to play around with Rocket Money’s features very well, you can save a minimum of $100 per year. Some users save more money than that depending on the number of subscriptions they are on. So a few hundred dollars that could have gone waste can be saved with the help of Rocket Money!

How Does Rocket Money Work?

From the mission of Rocket Money, it’s clearly stated that helping you get better at your finances is their utmost priority – because of that users are provided with so many coherent features and tools to help them achieve exactly that.

There are four main features offered by Rocket Money and each one of them has been explained below. The four main features are;

- Bill Negotiation

- Subscription Tracking

- Outage Monitoring

- Electric Saver

Take a look at each, before you get the Rocket Money app so that you don’t get lost.

1. Bill Negotiation

The bill negotiation service has helped thousands of users of Rocket Money to save not less than 20% on their telecom bills. Rocket Money has negotiators who directly reach out to service providers, mostly telecommunication service providers including internet, cell, and cable to find the lowest possible rate or promotion that its users could benefit from.

According to a report from Debt.com, only 33.3% of Americans are keeping a household budget – therefore to raise the numbers, people have to do everything possible to reduce spending. Rocket Money helps its users to save up to $512 every year.

For Rocket Money to also help you save $512 every year, you have to upload a copy of the recent bill of the service provider as well as little detail of the service you’re getting from this provider. After doing these, Rocket Money will help you get either a cut back on fees, promotional rates or a better low rate plan.

What the app takes in return for lowering your bill is 40% of the amount you saved for the year. Supposed Rocket Money helped you save $400, $160 of the money goes to them – and the app usually takes the 40% in the first month.

2. Subscription Tracking

The main reason why you’d want to use the Rocket Money app is the ability to track your monthly subscriptions and spending.

To enjoy this amazing feature, kindly link your credit card and bank account to the Rocket Money app. The app will then look at all your transaction history to highlight all subscription bills that are recurring, as well as the subscription costs that have been altered along the line without you being aware.

When Rocket Money reveals the transaction data and you think there are subscriptions you no longer need, you only have to tap on the button “ Cancel Service” to cancel that plan. However, to get access to this feature, you’ve to upgrade to the premium plan of the app. That costs $4.99 per month and $35.99 annually.

Moreover, Rocket Money maps your subscription bills to a calendar so you would know the exact date you shall be paying each of your subscriptions.

Looking at the transaction data you will get from the Subscription Tracking feature, even if you don’t upgrade to the premium version, there’s enough data to help you change your ways. You can enjoy the free plan and contact companies directly to cancel subscriptions you no longer need.

Another cool thing is that Rocket Money can get your money refunded when you cancel a subscription. But for overdraft, your fees may be waived!

3. Outage Monitoring

Outage Monitoring is another amazing feature that has been introduced by Rocket Money to help users save more. The app does this by keeping an eye on the internet and cable providers in your region, if any outage is detected, Rocket Money requests refunds or credit to your account. For Outage Monitoring alone, the app helps its users to save an average of $96 per year!

4. Electric Saver

Rocket Money has partnered with Arcadia Power to help its users pay lower electricity bills. However, the Electric Saver feature is available to users in regions where electricity is deregulated.

Rocket Money and Arcadia Power do their due diligent work to find the cheapest price of electricity per kilowatt so that users can save more money on electricity bills. Rocket Money users claim that with this amazing feature, they save not less than 30% of electricity per month.

Other features available on Rocket Money are;

- Autopilot Savings

- Budgeting

- Net Worth

- Spending Insights

- Credit Scores.

How Much Rocket Money Charges?

The app is free to use – the free version gives you the subscription tracking feature without the “Cancel Service” option. There are other features that are made available only on the premium plan.

The Premium plan ranges from $3 to $12 per month, that’s $36 – $48 annually. Other amazing features available for premium are;

- Concierge

- Realtime Balance Syncing

- Premium Chat

- Unlimited Budgets

- Credit Reports

- Smart Savings Accounts and many more.

Also, remember that for the Bill Negotiation feature the only time you will pay Rocket Money is when it helps you save some amount on your subscription plan. 40% of the amount you saved goes to the app. If the negotiation fails, you pay nothing.

Does Rocket Money Sell My Information? Is It Safe To Use?

No, Rocket Money does not sell your information – so yes, it is safe to use. First and foremost, Rocket Money is hosted on Amazon Web Services. Amazon Web Services is regarded as one of the most secured and reliable hosting services available with over 7,500 government agencies using it – including NASA, FINRA, and the Department of Defense.

Moreover, Rocket Money uses Plaid to connect with financial institutions and therefore there’s no need for the app to ask for banking credentials. There’s also a bank-level 256-encryption that protects your data 24/7 from potential hackers.

Pros and Cons Of Rocket Money

Pros | Cons |

|

|

Rocket Money Alternatives To Use

Billshark Overview | Rating | |

| 4/5 |

Trim Overview | Rating | |

| 4.5/5 |

Final Words On Rocket Money

So is Rocket Money a legit bill negotiation app? Yes, however, if you’re already winning the billings and savings game, then I’d say going in for Rocket Money is a waste of time and money. Even so, if you’re part of the people who are struggling to keep a budget because of bogus subscriptions you’re paying for – then download the Rocket Money app today.

Trim and Billshark also give you amazing features at affordable prices but there is nothing like the Electric Saver and Outage Monitoring features. The 40% that’s charged on the amount saved when using the Bill Negotiation feature may be considered expensive. But I guess saving 60% is better than saving nothing.

All same, Rocket Money is a great app that can help you in your financial journey, so if you like all that it offers, go for it. I’m wishing you more dollars and freedom!

Manuelo is an entrepreneur and a personal finance nerd. He is the founder of Dollars And Freedom. An expert in side hustles, online gigs, and everything about making money. His works have been featured on major financial publications, such as Business Insider, GoBankingRates, Investopedia, Entrepreneur, and more. When he’s not busy with his blog or writing for others, you’ll catch him hanging out with loved ones or reading books on stoicism and self-development.