How to Get Free Stocks in 2023: Buy Shares Of Your Favorite Companies.

This post may contain affiliate links. Therefore, should you click and make a purchase with these links, we may earn a small commission at no extra cost to you. On DollarsAndFreedom, we recommend only the best for our readers. For more information, visit our Disclaimer Page.

There are some great brokers that are ready to give you free stocks in 2023 just for signing up with them. So if you have finally decided to start your investment journey these brokers or brokerage apps are the best to get free stocks.

Receive financial tips, side hustle ideas, money-saving tips, and more.

The word Investing sounds formidable to many people – but in reality, that’s where the most money can be made.

Well, I don’t know your financial goals and how fast you want to achieve them. Because after a fastlane income vehicle – that’s increasing your income by working on side hustles online, building a high-income business, or something of that sort, the next best way to achieve your financial goals fast is by investing.

So if you’re one of those people who freak out when you hear about investing – I would say try to normalize the word and do whatever you can to love it partially if not wholly.

In this article, we’re talking about stocks but there are many types of investment you would want to know…

What Are The Types Of Investments?

- Bonds

- Stocks

- Real Estate

- Annuities

- Mutual Funds and ETFs

- Retirement( 401(k), IRA, etc)

- Options

- Bank Product

- Cryptocurrencies

How To Get Free Stocks – List of Brokers

Brokers | Requirement | Commission | Offer | Join Today |

$100 minimum deposit | None | $50 worth of stock | ||

$100 minimum deposit | None | 5 free stock | ||

Any amount deposit | None | Up to $300 worth of stock | ||

Just sign up | None | 1 free stock | ||

$5 minimum deposit | None | $5 worth of free stock | ||

$1,000 minimum deposit | None | $100 worth of free stock | ||

$2,000 minimum deposit | None | Up to $3,500 worth of free stock | ||

Just sign up | None | 2 free stock |

Let’s take a deeper look into each of the brokers that give you free stock upon signing up. Some do require you to deposit some amount before you get the bonus, while others do not.

All the same, these brokerage apps give freshers in the investing world a conducive environment to succeed – therefore take advantage of these offers.

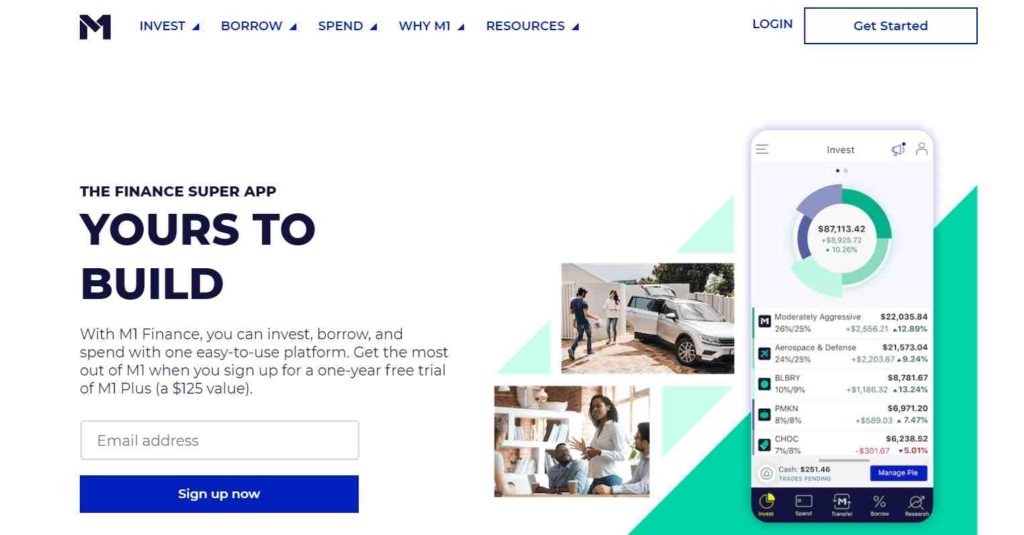

1. M1 Finance

M1 Finance is one of the few brokers that are free to sign up and offers you many other amazing services you would get from probably no other app( Invest, Borrow, and Cashbacks from using credit)

At the moment, M1 Finance is offering anybody who signs up and deposits $1,000 a free $500 in stocks. If $1,000 is too much for you, starting with at least $100 would still get you $50 in stocks!

Take advantage of the fractional shares opportunity offered by M1 Finance. Fractional shares allow you to buy part of the share of a stock if you don’t have enough money.

Therefore suppose you want to buy a stock of Facebook but can’t pay for the stock in full, M1 Finance would allow you to pay a percentage of the price of the stock. This feature, therefore, makes it possible for you to invest in big companies with larger share prices.

Moreover, if you want to invest but don’t know how to perfectly choose the stocks – M1 Finance would automate your investment the right way. Just deposit your money and go have fun, M1 Finance would pick the right stocks that suit your preferences and maintain your portfolio using a feature called automatic rebalancing.

Other cool features M1 Finance offers.

- The Pie

A dashboard that provides you with over 6,000 stocks. The Pie is divided into two: A Custom Pie that allows you to pick your own stocks and build your own portfolio and an Expert Pie that provides you with over 80 groups of stocks that have been carefully grouped based on different strategies and financial goals.

- Borrow

Borrow 35% of your portfolio’s value with just a 2% interest rate. For Plus members, the interest rate may be even lower. In a situation where a bank requires collateral – your portfolio on M1 finance can also be used.

- Many account types.

The first is the Brokerage account which comes in 2 forms: The Individual and Joint account. ( Joint account is for parents, children, couples or even mutual friends who want to invest together)

There’s also a Custodial account, Retirement account, and Trust account.

- Spend Credit

Get between 1% and 10% cashback when you make a purchase from big brands like Netflix, Delta Airlines, Peloton, Spotify, Apple, and Popeyes – Provided they’re in your portfolio.

Start investing now with M1 Finance and get $50 for free to purchase any stocks of your choice.

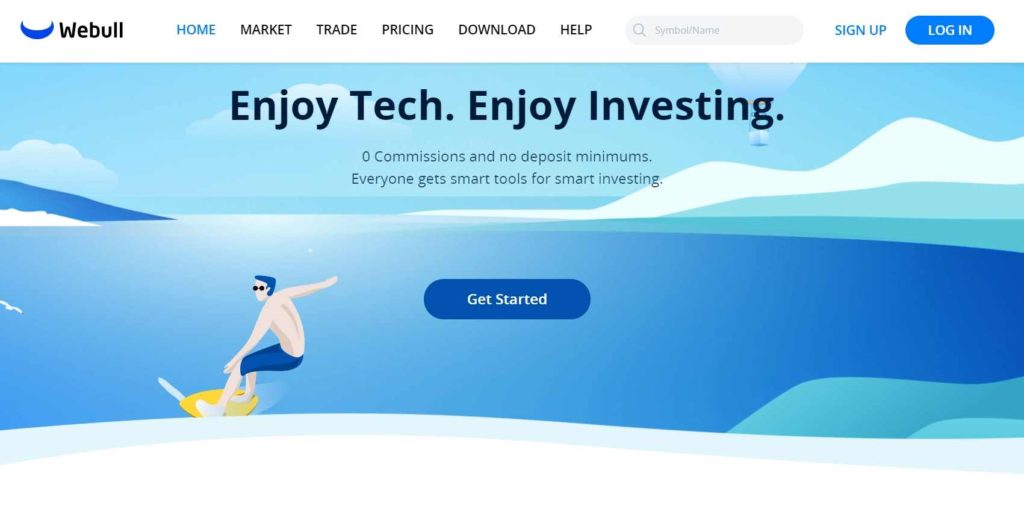

2. Webull

One interesting news is that Webull recently introduced fractional shares! Therefore, you can pay for a small percentage of a stock of the sexiest companies out there! You just need a minimum of $5 for the fractional share.

However, not all the big companies are available for fractional shares on Webull. For instance, Apple Inc. (NASDAQ: AAPL) and Berkshire Hathaway(NYSE: BRK.A) have no fractional shares.

Are dividends paid on fractional shares on Webull? Absolutely! You are paid dividends when you own a fractional share of a company that pays dividends – but the dividend is split based on the fraction you own in the stock.

Webull also gives you Instant Buying Power. So if your ACH deposit is in transit, which usually takes 6 business days for it to show up in your account, you can still have access to the market with your Webull credit.

Moreover, Webull allows you to trade in ETFs, Options, as well as ADRs.

Positives Of Webull.

- No minimum amount is needed to start trading.

- No commission.

- App is available for iOS and Android.

- 24/7 customer support.

- Great tools for analysis.

Negatives Of Webull.

- Fractional share isn’t possible for all companies.

- No Dividend Reinvestment Program(DRIP)

- The Instant Buying Power is a bit tricky.

Webull is one of the best brokerage apps to use. Sign up now and get 2 or more free stocks!

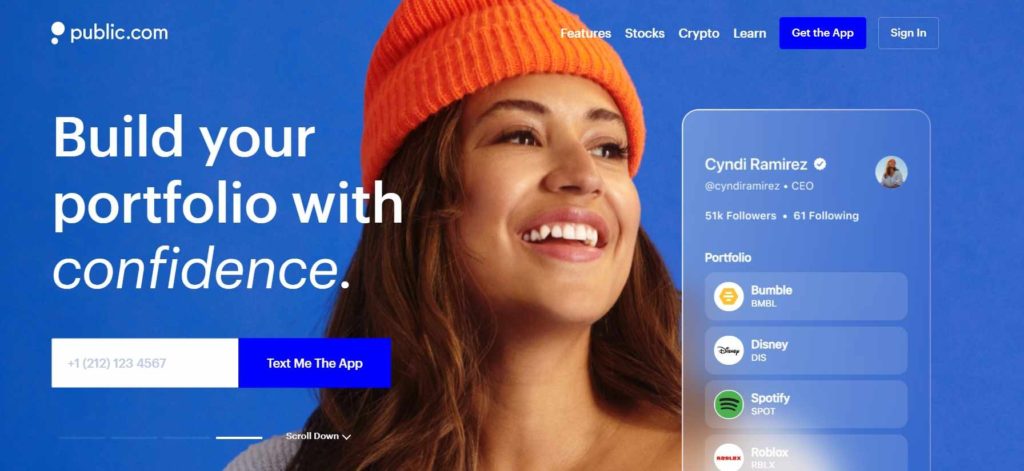

3. Public.com

Public.com allows you to own a slice of a company through stocks, allows you to swim in the pool of Cryptocurrency, as well as Exchange Traded Funds(ETFs) with as little as $1.

One thing I love about Public.com is its social features that give you the opportunity to learn more about investing. Because investing as it may seem so fun, only requires you to know what you’re doing before you can succeed – you cannot just pick any stock and hope that it goes well.

On the social feature, you get the privilege to interact with people who have a strong foundation in investing, or have more experience than you. You can join groups to learn about stock picking, EFTs, and Crypto.

In addition, fractional shares are also available on Public.com – so again, you would be able to buy a percentage of a stock if you don’t have money to buy a full stock upfront.

But take note here: If you later decide to transfer your portfolio to another broker, all your fractional shares would be liquidated and the money would be transferred to you. Fractional shares can’t be transferred to a different broker on Public.

There’s also another feature known as Themes which allows you to filter your company search – you get the best-matched companies based on categories you select.

Some of the categories under Themes to explore are Green Power, Public Top 20, Crypto Assets, Wearables, American Made, Metaverse, just to name a few.

Positives Of Public.com

- No minimum amount is needed to start trading.

- No commission.

- You can pick many stocks for long-term investment.

- Social features are available for you to connect with others and learn more.

- Fractional shares are available.

- The public app is available for iOS and Android.

When you join Public.com you get $70 or more cash you can use to pick any stock of your choice.

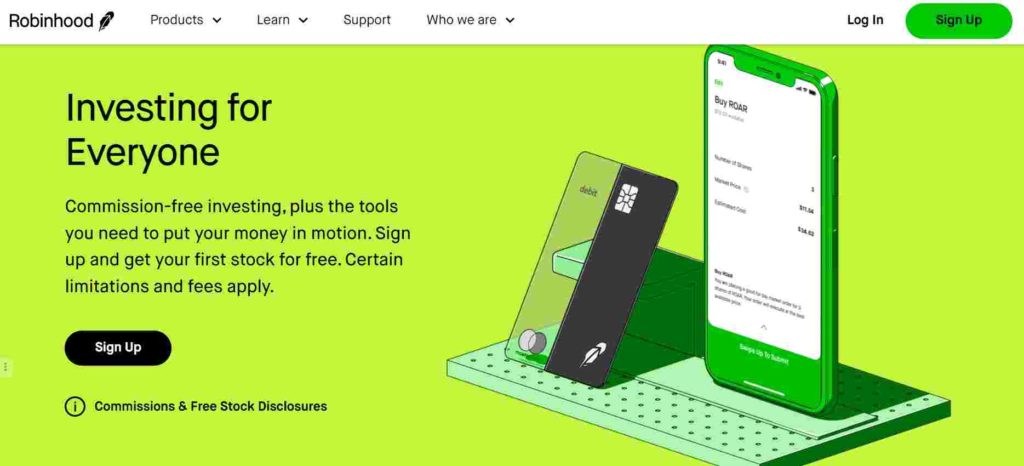

4. Robinhood

Robinhood is actually the pioneer of commission-free trades. The main goal was to make investment accessible to all people.

Signing up on Robinhood is absolutely free, besides you only need a dollar to start trading stocks on the platform. Apart from trading stocks, you can also trade Options, ETFs, and Cryptocurrencies.

Robinhood again has one feature called Cash Management where you’re given a customized debit card from Sutton Bank.

This card can be used at any place where Mastercards are accepted. This Cash Management is a nice way to earn a 0.30 APY through spending and investing with Robinhood.

After signing up, check out Robinhood Gold; a paid plan that gives you more control over your portfolio. The Gold comes at a cost of $5 per month. Here are some of the things you enjoy on Robinhood Gold:

- Eligibility of borrowing money on Robinhood at just 2.5% interest rate.

- Huge instant deposits.

- In-depth market data and research reports to help you become a better investor.

Positives Of Robinhood.

- Fractional shares available.

- No minimum amount needed to start trading.

- Commssion-free trade.

- Many investment alternatives. Stocks trading, ETFs, Crypto, Options, etc.

- Borrow money on Robinhood Gold.

- Ability to earn interest from Cash Management.

If you have decided to start your investing journey with Robinhood, then sign up and get a free stock worth between $2 and $200 after your account has been approved.

5. Stash

On Stash, you are encouraged to invest for the long term. Unlike other brokerage apps, Stash is more than just investing. Users on Stash can spend and make money in return!

This is kind of similar to how cashback apps work but for this time around, you’re getting a free stock in return all because you decided to spend on Stash.

Users who are interested in Banking are given Stock-Back Cards and would get stock in return whenever they purchase something from a brand.

The banking comes with three plans: Stash Beginner, Stash Growth, and Stash+, at a monthly fee of $1, $3, and $9 respectively.

For normal everyday buys like groceries, travel, and gas, you would earn stock in return but for activities like bill payments and ATM withdrawals, no stock would be earned.

If you’re new to investing, Stash has a helpful plan for you to improve your investing skills. Stash has many articles and videos to help you become a better investor.

All the same, if you think you wouldn’t have enough time to focus – Stash makes it possible for you to automate your investing; you only have to decide the amount you want to invest at any point and Stash would gradually build a nice portfolio on your behalf.

Trade Stocks and ETFs on Stash! You can also secure your retirement by creating an IRA( Retirement account) – There’s also a Children’s Investment Account you can create for your kids.

Positives Of Stash.

- No minimum amount is needed to start trading.

- Ability to create a bank account.

- Stock-Back cards available to earn stock whenever you shop.

- Retirement account.

- Children’s investment account available.

- Fractional shares available.

Join Stash and get $5 worth of stock for free instantly.

6. Schwab

Schwab has a Robo-advisor which you can use to build a diversified portfolio from stocks and ETFs that have been carefully selected by investing experts on the platform.

In fact, Schwab is one of the most popular brokers in the United States. Moreover, unlike Robinhood and some other brokers, Schwab has a physical location as well. Its headquarters can be found in Westlake, Texas.

For someone who has little or no knowledge in investing, the platform makes it possible for you to seek advice from Financial Consultants to help you meet your investment targets – and the amazing news is that, financial consultation is free.

Schwab is one of a kind in terms of customer support – It’s 24/7! You can also have a live chat with the experts on the platform should you run into any obstacle.

Schwab has a well-structured system to speed up your investment success – Therefore the chances of losing money on the platform through investing are very slim.

The only downside of using Schwab is that you pay commissions whenever you trade. For instance, automated phone trades cost $5, Trades for stocks, Options, and ETFs that are assisted by the broker also cost $25. The only commission-free trades are ETFs and Online listed stocks.

Schwab again has a banking system where you get a Schwab Bank debit card and can be used outside the U.S. without paying a foreign exchange transaction fee.

Positives Of Schwab.

- Free to join.

- Many investment alternatives. Stocks, ETFs, Mutual Funds, Options, Futures, International stocks, Bonds and Fixed Income products, etc.

- Fractional shares are available. A minimum of $5 to invest in companies in the S&P 500.

- Free financial consultation.

Negatives Of Schwab.

- You pay commissions for trading.

Schwab gives every new member $100 worth of free stocks. Sign up process is fast and easy to complete.

7. Moomoo

Moomoo makes it possible for you to buy stocks of companies before they go public(IPO). For residents of the United States who want to invest in foreign companies, y’all can do that on Moomoo.

Moreover, you get the chance to invest in Hong Kong companies at any time without worrying about exchanging currencies because that can be frustrating – No more hassle, with Moomoo.

Moomoo works with Futu Inc. which is a very reputable company. Therefore it’s safe to invest with this brokerage app.

On Moomoo you shall be able to trade ETFs, ADRs, and US stock without paying a penny as a commission. There’s also 24/7 customer support in case you need any guidance.

Positives Of Moomoo

- Trade US stocks, Options, ETFs and ADRs.

- Free to create an account.

- Commission free trading.

- Reports, data and tools to help improve your investing skills.

After signing up, you have to wait for your account to be approved. Once it’s approved, Moomoo gives you a free stock that is worth between $3 and $3,500.

That’s not all – if you deposit a net of $1,500 or more, would you be rewarded with another free stock of companies like Facebook, Apple, and Tesla.

8. First Trade

This is yet again another brokerage app. First Trade allows you to trade stocks, Options, ETFs, and many more. You can also create an IRA at no cost, to find security for your retirement.

Should you buy stocks of companies that pay dividends, there is a Dividend Reinvestment Program you can join to reinvest your dividends.

In case you want to invest with your partner, friend, or relative, there is a joint brokerage account to make this possible.

The First Trade app is available for iOS, Android, and PC.

Positives Of First Trade.

- No commission

- Free IRA.

- Referral program to win additional stocks

- Long trading hours( Pre Market, After Market, Day + Ext)

When you sign up on First Trade, you’re given a free stock – And an additional stock when you deposit $100 or more within the next 30 days after your account’s approval.

9. Bumped

The way Bumped works is similar to that of cashback apps like TopCashback, Ibotta, Dosh, and many more. So whenever you shop from any brand partner of Bumped on the platform, you get a free stock in return.

But note that you wouldn’t be given a full stock for just shopping one time – you shall be given fractional shares instead.

Creating an account on Bumped usually takes a few minutes to complete – and once you’re done, you get $1 worth of stock instantly from Bumped.

After creating your account, choose only one company in each loyalty category( For instance – Choose Spotify from the entertainment category and Starbucks from the coffee category)

Some of the categories are Entertainment, Apparel, Transportation, etc.

Link your account to your credit card and continue getting fractional shares whenever you shop!

Positives Of Bumped.

- Get fractional shares whenever you shop.

- Creating an account is free.

- 1000+ brands to own shares.

Join Bumped and become a shareholder of the brands you love best. Register and link your credit card – So simple.

10. TD Ameritrade

One of the giants among the brokerage firms out there, TD Ameritrade. Its top competitors are Schwab, Robinhood, Webull, and a few others.

TD Ameritrade initially offered no commission-free trading of stocks but has followed the footsteps of Webull, Robinhood, etc.

However, the only commission-free tradings are ETFs, options, and stocks that are listed on the US stock exchange. But for stocks that are not listed on the US stock exchange, you’re required to pay a commission for trading.

TD Ameritrade has a very robust platform to help you monitor your trade and investment both for the short and long term.

Before you get a bonus or free stock on TD Ameritrade – one has to make a money deposit.

Have a look at some of the deposits you have to make on TD Ameritrade to get bonuses:

- A $250,000 deposit gets you a bonus of $350.

- A $500,000 deposit gets you a bonus of $700.

- A $1,000,000 deposit gets you a bonus of $1,500.

- A $2,000,000 deposit gets you a bonus of $2,500.

Positives Of TD Ameritrade.

- IRA is available.

- No commission for trading stocks, ETFs, and options.

- Huge bonuses.

- Powerful platform.

Negatives OF TD Ameritrade.

- A huge deposit is needed.

TD Ameritrade is one of the best brokers in operation, so if you have enough money to invest then sign up and claim the amazing bonuses that come along.

11. Acorns

There are more than 9 million people using the Acorns app for investing. Acorns invest your leftovers after every spending with what’s called Round-ups. For starters, this would be helpful in your investing journey.

Acorn would build a diversified ETF portfolio for you over time after filling out your profile at just $3 per month.

There’s also the Dollar Cost Averaging which you can take advantage of to automate your investing in a recurring manner.

Over 12,000 brands have partnered with Acorn which means you stand a chance of winning an investment bonus from any of these brands whenever you shop with Acorns.

Moreover, if you want to save for retirement – you have Acorn Later to help you do this. Set the account at recurring and go have fun whiles Acorn secures your retirement.

Acorn Early is also there for your children to start investing – teaching your kids how to invest is the best thing you can give them.

Positives Of Acorns.

- Automate your investment using recurring.

- 256-bit encryption to fully protect your data.

- Learn how to invest from financial content powered by CNBC.

- IRA investment.

Investing with Acorns isn’t free, however, the fees you pay aren’t something you cannot afford – and looking at the amazing offers on the platform, it’s worth it. After signing up for Acorn, you would be given a $10 bonus.

12. iConsumer

Every customer is a shareholder on iConsumer. Create an on iConsumer, shop at any of its partner stores, and become a shareholder!

Unlike other platforms where you get shares of the partner brands, this time around you’re getting shares of iConsumer.

There are more than 2,000 stores or brand partners of iConsumer. Some of these brands are Petco, eBay, Staples, Amazon, Walgreens, and Expedia.

The iConsumer app is available on both Apple and Google Play stores. Once you sign up you get 100 shares instantly. More iConsumer shares can be gotten when you refer other people to join( 250 shares plus $10 for every referral).

Creating an account is easy; use your Facebook account or your email and a password. At some point, iConsumer would ask for your Social Security Number but you have nothing to worry about since all information is well protected.

Positives Of iConsumer.

- Free sign up.

- Earn shares for shopping.

- Referral program to earn more shares.

Sign up for iConsumer – Who knows where this company would be in the next 10 years? Become a shareholder now.

13. Nvstr( Tornado)

The name Nvstr has recently been changed to Tornado. The platform is well built to the extent that you can hone your portfolio with just a single click.

Choosing a stock is also hassle-free because there is a filter you can use based on your preferences and objectives. You have the chance to handpick your own stocks – Or better still, go in for diversified ETFs.

On Tornado, there is a community feel – Feel free to connect with people who have experience in stock trading or investing in general, to learn from them.

There’s even a 1-on-1 Q and A you can have with masters of the game. This would help you make the right investment moves.

The Tornado app is available for iOS, and Android.

Creating an account on Tornado is free but the only con is that you pay commission whenever you trade, unlike some other brokerage apps where there’s commission-free trading.

Positives Of Nvstr( Tornado)

- Optimize your portfolio with just a single click.

- The great community feel on the platform.

- Account creation is free.

The free stock you would get after signing up can be worth from $9 to $1,000. Create your account and make your first trade within the first 30 days to win your free stock.

Note: The free stock you win can’t be traded within the first 12 months.

14. E*Trade

E-Trade offers many investment options including Bonds, Futures, Stocks and options trade, ETFs, Mutual Funds, Retirement accounts, and many more.

E*Trade app is available for both iOS and Android. The website has investment reports and data to help you make the best decisions.

All online US-listed stocks, options, and ETFs are commission-free to trade. Apart from this, you get the chance to win cash bonuses after creating your brokerage or retirement account. However, you have to make a cash deposit in order to receive this cash bonus.

Here are some of the deposits you have to make and the cash bonuses to get in return.

- $10,000–$19,999 deposit for $50 cash credit.

- $20,000–$49,999 deposit for $100 cash credit.

- $50,000–$99,999 deposit for $200 cash credit.

- $100,000–$199,999 deposit for $300 cash credit.

- $200,000–$499,999 deposit for $600 cash credit.

- $500,000–$999,999 deposit for $1,200 cash credit.

- $1,000,000–$1,499,999 deposit for $2,500 cash credit.

- $1,500,000+ deposit for $3,500 cash credit.

When you refer a friend or anybody to join E*Trade, you’re given a $50 Amazon gift card every time. This is also another way to earn on E*Trade.

Positives Of E*Trade.

- Free to sign up.

- Many trade options - Stocks, ETFs, IRA, options, etc.

- Commission-free trading.

- Referral program to earn Amazon gift cards.

- Cash credit for both IRA and Brokerage account.

15. DiversyFund

DiversyFund allows you to own shares of multifamily real estate. Real Estate is one of the smoothest and stable forms of investments.

People like Grant Cardone, Robert Kiyosaki, and Manny Khosbin have used this form of investment to grow their wealth over time.

The minimum amount you need to start investing in real estate with DiversyFund is $500. The process has been automated, all you have to do is to invest. DiversyFund’s customer service is handy anytime you need help.

All the real estate professionals that work with DiversyFund are veterans – moreover, before a property is chosen by DiversyFund many factors like trends, population growth, and market comps are considered.

Their final decision is also supported by real-world data and tech- therefore you’re more likely to succeed should you invest with them.

Positives Of DiversyFund.

- Decisions are taken by professionals on DiversyFund.

- Just $500 is needed to start your real estate investment journey.

- Automated process.

DiversyFund gives a $50 or $100 Amazon gift card to all new members after signing up and making the $500 deposit.

Frequently Asked Questions

- Why is it good to invest in the stock market?

Investing in the stock market is one of the most effective ways to get ahead of inflation. Money saved at a bank or in a money box gets little or no raise at all, and over time, its value would depreciate.

Although investing in the stock market is a risk and you might lose some or all of your money but the data below shows that long-term investment brings greater returns especially in the S&P 500 index.

- Can you invest $1 in stocks?

Yes, you can. Look for brokerage apps that allow fractional shares. Currently, you don’t need to be rich to start investing.

- Why do companies give free stocks?

It’s a form of business strategy brokers use to get many customers on board. In the long run, brokers and customers both benefit( Mutual Relationship).

Manuelo is an entrepreneur and a personal finance nerd. He is the founder of Dollars And Freedom. An expert in side hustles, online gigs, and everything about making money. His works have been featured on major financial publications, like Business Insider, GoBankingRates, Investopedia, Entrepreneur, and more. When he’s not busy with his blog or writing for others, you’ll catch him hanging out with loved ones or reading books on stoicism and self-development.

Having numerous avenues for generating income can be overwhelming, especially if you're unaware of the most effective methods to begin earning. Here are some exceptional side hustle ideas that can help you start earning money.

Hey there! Quick question that’s totally off topic.

Do you know how to make your site mobile friendly? My site

looks weird when viewing from my iphone 4. I’m trying to find a template or plugin that might be able to resolve this problem.

If you have any suggestions, please share. Thank you!

If I may ask, which website theme are you using? Is it a free theme?

I would also like to know the domain name of your site!

Hi there, I enjoy reading through your article post.

I like to write a little comment to support you.

I quite like reading an article that will make men and women think.

Also, thanks for allowing me to comment!

Thanks for stopping by!