Moka Review (2024): Is It Good for Investing?

Building wealth can’t be done without developing the habit of saving and investing. These two go hand in hand. But the reality is, they’re very difficult to master especially if you’re a low-income earner. However, with Moka (formerly known as Mylo) you can save and invest on autopilot.

This article reviews the Moka app, a Canadian investment app to help you save and invest, so you can reach financial stability with ease! Is Moka good for investing? How does it work? How much are the fees? Should you choose Moka? At the of this review, you’d get to know whether Moka is an app you should consider.

Do you want other ways to make easy money? – Check these out:

- Acorns: Grow your wealth by investing your spare change.

- Branded Surveys: Answer online surveys on your phone and earn $50+ per month.

Moka Quick Review

- App: Moka

- Available On: iOS and Android

- App Category: Saving and Investing

- Minimum Investment: $0

- Monthly Fees: $3.99

- Account Type: TFSA, RRSP and Taxable

- Description: Moka is a Canadian spare-change app that makes wealth building very easy through the use of autopilot saving and investing. Canadians can now save and build an investment portfolio just by pressing a few buttons on their phone, and allowing Moka to do the rest.

Facts About Moka?

Moka started in 2017 as Mylo by Phil Barrar. Mylo made its first appearance on Dragon’s Den episode in 2018, and has been a hit in Canada ever since! The app is the first of its kind, that has given Canadians the opportunity to save and invest their spare change automatically.

In 2020, the name Mylo was changed to Moka when the company decided to expand its boundaries. Currently, Moka is available in France.

The app has been embraced warmly by Canadians, with more than 750,000 downloads in Canada alone. Moka runs on iOS as well as Android. The app operates similarly to that of Acorns, KOHO, WealthSimple, Trim, and others.

Who Qualifies To Use Moka?

Anyone who is 18 years or older, and is a resident of Canada or France, qualifies to use the Moka app. The Moka app can be downloaded with an iPhone or Android. For PC users, I’m afraid – Moka currently has no PC version.

How Does Moka Work?

Moka saves and invests spare change automatically by rounding up every purchase you make. For you to understand, suppose you buy a coffee at $2.45, Moka rounds it up to $3.00 and automatically saves the $0.55 on your behalf.

This deduction continues throughout the week, whenever you make a purchase with your debit or credit card.

Once a new week starts, all roundups that have been accumulated are withdrawn from your linked bank account and invested automatically by Moka, to build your portfolio.

This means you don’t have to downgrade your lifestyle or live a completely frugal life. Moka makes it so easy and smooth that you wouldn’t even notice.

Moreover, Moka wouldn’t withdraw money from your bank account if you have less than $25 in it. So, there’s no way there would be an overdraft.

Other Ways To Grow Your Wealth On Moka

Roundup Multiplier.

The roundup multiplier gives you the chance to invest more by multiplying every spare change after making a purchase. The multiples start from 2x, all the way to 10x.

For instance, if you choose 4x and there’s a roundup of $0.65 after buying a $3.35 sandwich, the round up would be multiplied by 4 – meaning, $2.60 would be deducted from your account by Moka.

One-time Investment.

This option makes it possible for you to deposit a huge amount of money all at once into your Moka account. Let’s say, $1,000.

Recurring Investment.

This option allows you to set a specific amount to be deposited automatically into your Moka account every week. For example, $100 per week.

Taking advantage of these options would quicken your investment to enable you to achieve financial stability.

Investing With Moka

With Moka, you can invest using a personal non-registered taxable account, TFSA or RRSP. The money you’ve saved in your Moka account would be managed and invested by a certified portfolio manager of the Tactex Asset Management. Your money is therefore in safe hands since Tactex at the moment takes care of assets worth over $200 million.

Moka invests your money (spare change) in a diversified portfolio of low-ETFs. This could be done by an individual investor, nonetheless, for someone who doesn’t want to do all the nitty-gritty stuff related to investing – allowing Moka’s certified managers to do it for you would be much easier and safer.

Moka gives you five ready-made portfolios to choose from. Have a look:

- Conservative: purposely for saving (100% Moka Money ETF)

- Conservative-Moderate: 60% bonds and 40% savings

- Moderate: 60% bonds and 40% stocks.

- Moderate-Aggressive: 40% bonds and 60% stocks

- Aggressive: 20% bonds and 80% stocks.

Note that the decision of Moka to choose a particular portfolio on your behalf would depend on things like your financial goals, investor horizon and profile, and how willing you’re to take a risk. Moka knows this information because you’d be asked when signing up for the app.

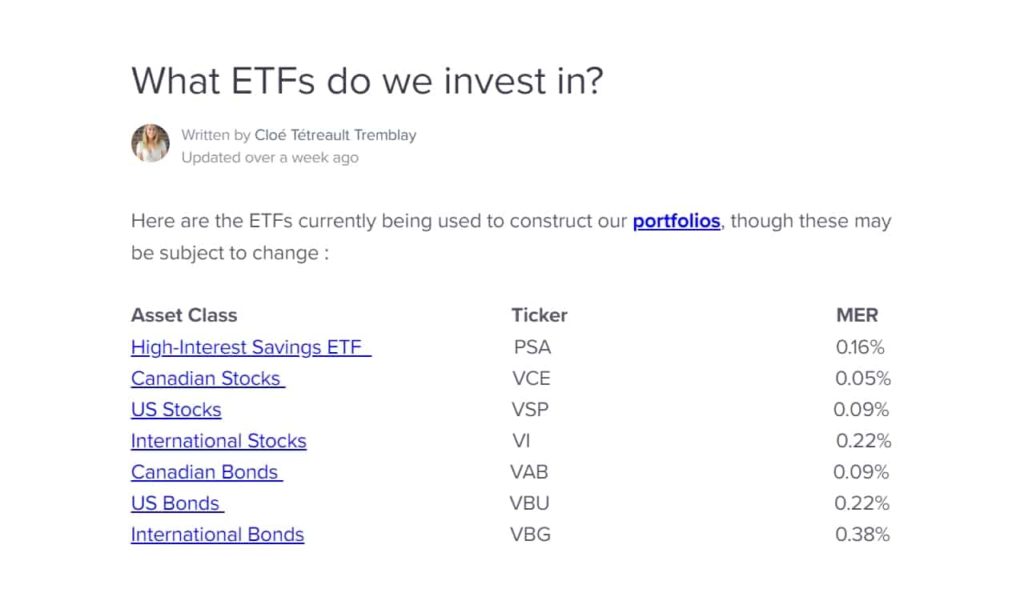

Additionally, there are ETFs that Moka uses to build portfolios. You have the chance to invest in all of them. They’re seven, have a look.

How To Sign Up For Moka.

If you don’t want to be taxed, open a TFSA or RRSP account; these are tax-free and the best option for young college students to get high returns on their investment.

After signing up, Moka has a referral program you can join to receive $5 anytime you invite someone to sign up for Moka.

Signing up takes a few minutes. Follow these steps:

- Click here to get to the website of Moka

- Proceed to create your account.

- Answer a few questions about yourself and your financial goals, risk tolerance, and your present financial status.

- Connect your bank account to Moka.

After doing this, Moka would then select the right portfolio based on your investor profile. So it is advisable to let Moka know your reasons for wanting to invest. Are you investing for short term or retirement? Are you investing to purchase a house, or go on a trip?

Other Benefits Of Moka App

After giving you a conducive atmosphere to save and invest, Moka again provides other benefits to help you accumulate more money fast!

1. Moka Perks (Cashback)

Moka Perks are amazing and a great way to save more money! This is how the feature works: whenever you claim a perk from the Moka app and move on to shop at brands like Uber Eats, Instacart, Domino’s, and Apple Music, you get a cashback! Moka Perk works like other reward apps such as Ibotta and TopCashback.

So anytime you want to shop at a brand store, shop through Moka to get a percentage of your money back! This cash can pay for your $3.99 Moka monthly subscription.

2. Moka 360

The Moka 360 comes with so many features that you might want to consider. Some are:

1. Bill negotiation feature to help you save on your internet, cable, and phone bills. Similar to what Rocket Money does for you.

2. Advanced financial coaching. Just like what the Cleo app does for you.

3. Personalized debt repayment plan. Similar to what Twine does for you.

Other benefits you’re getting are:

- Cashback perks. But this time around, the cashback is doubled!

- Round up to give. This is a way you can donate some of your spare change to any registered Canadian charity. There are 85,000 of them.

How much does Moka 360 cost? Moka 360 is a premium plan that costs $15 per month. That I believe is freaking expensive! Even so, looking at the features you’d be getting, you shall earn more than what you’re paying. Moka claims they save users an average of $250 annually. Therefore, subscribing to Moka 360 at $180 per year wouldn’t be a bad move.

If you later decide to stop using Moka 360, there’s a 200% money-back guarantee!

How Much Does Moka Cost?

Moka charges a fundamental fee of $3.99, no matter how much you’re investing. That means you can have $500,000 in your Moka account and still pay $3.99. This fee gives you access to a well-managed portfolio, as well as autopilot savings and investing.

The $3.99 does not include the Manage Expense Ratio or MERs. You’d have to pay that separately. MERs are fees that are paid to the companies that take care of ETFs. For a normal portfolio, the fee ranges from 0.06% to 0.38%. This fee doesn’t go to Moka.

How To Withdraw Your Money From Moka

All withdrawals must be done before 1 pm, from Monday to Friday – weekends are out. Note that if a withdrawal is made after 1 pm, you would have to wait till the next day to receive your money.

If you don’t know how to withdraw money on Moka, follow these steps:

- Log into your Moka account and select the specific goal you want to withdraw money from, under the Overview section.

- On the new page, click and select withdrawal from the top-right corner.

- Enter the amount.

Moka charges no fees when withdrawing your money – it’s free and easy.

Pros & Cons Of Moka

Moka app has its positives as well as negatives. So let’s have a look at both to help you finally decide whether Moka is for you or not.

- Pros

- Availability of Socially Responsible Investment, also known as SRI.

- Round up to Give is available for donations.

- There are 7 portfolios to choose from.

- Save and invest using an automatic system.

- Receive cashbacks when you use Moka Perks.

- Free withdrawals.

- $0 to start investing.

- Cons

- The Normal and Moka 360 plan are both expensive.

- Because everything is automatic, you have less control even when things are going wrong.

- Depending on spare-change roundup investing only isn’t enough to boost your wealth.

- Customer service sucks.

Frequently Asked Questions

- Is The Moka App Safe?

You have the right to know what you’re getting into because some apps are zero percentage safe. But for Moka, it’s a 200% safe app. Your financial information is protected by a 256-bit encryption, SSL connection, and tight security policies. There’s no way your information would be hacked, moreover, Moka doesn’t sell your information.

- Who Is Moka For?

Moka is for beginners in investing, as well as people who find it difficult to save money. There are brokerages where you can start investing on your own but that means you’d have to manage your portfolio. Moka is for people who aren’t ready to take full control of their investments. The downside of Moka is that it’s expensive.

- How Do I Cancel My Moka Account?

Open the in-app chat and send a message to the customer service to close your account. Or send your message to [email protected]. If you don’t want cancel the account completely but just want to stop saving for a while, that can also be done in the app. Just pause the automatic round ups and deposit.

- What Are The Alternatives For Moka?

Wealthsimple is the main alternative for Moka. Acorns would have been the very immediate option but that’s available for US residents only. However, there are other apps that give cash-back rewards just like Moka Perks but aren’t for investing. You may want to know some of them:

- Rakuten – Pays cash back when you shop at over 1,000 stores.

- KOHO – Pays you to save and overcome debt.

- Drop – Gives away gift card when you shop online.

- Checkout 51 – Get rewarded when you buy groceries, gas, etc.

- Receipt Hog – Receive gift cards and PayPal cash.

- Caddle – Pays you to buy groceries.

Final Words On Moka Review

So, the question is: Is Moka good for investing? Well, in my opinion, if you’re new to investing, allowing Moka to build a portfolio on your behalf is a good thing to do.

Therefore, for a beginner, I would say YES! Moka is good for investing. Moreover, the idea of round up automatic savings can accumulate over time into a huge money.

But for someone who knows the ins and outs of investing, I’d say, do it yourself. There are brokerages that give free stocks upon sign up!

Again, Moka is expensive – a fixed $3.99 per month would benefit someone who’s investing thousands of dollars but would detriment someone who’s investing pennies. An option you may want to look at is Wealthsimple; one of the best robo advisors around.

All the same, if you want to try Moka – then go ahead because you wouldn’t regret. Sign Up Today. It’s good that you’ve taken the step to create the financial life you want. Wishing you more dollars and freedom!

Manuelo is an entrepreneur and a personal finance nerd. He is the founder of Dollars And Freedom. An expert in side hustles, online gigs, and everything about making money. His works have been featured on major financial publications, such as Business Insider, GoBankingRates, Investopedia, Entrepreneur, and more. When he’s not busy with his blog or writing for others, you’ll catch him hanging out with loved ones or reading books on stoicism and self-development.